Benefits

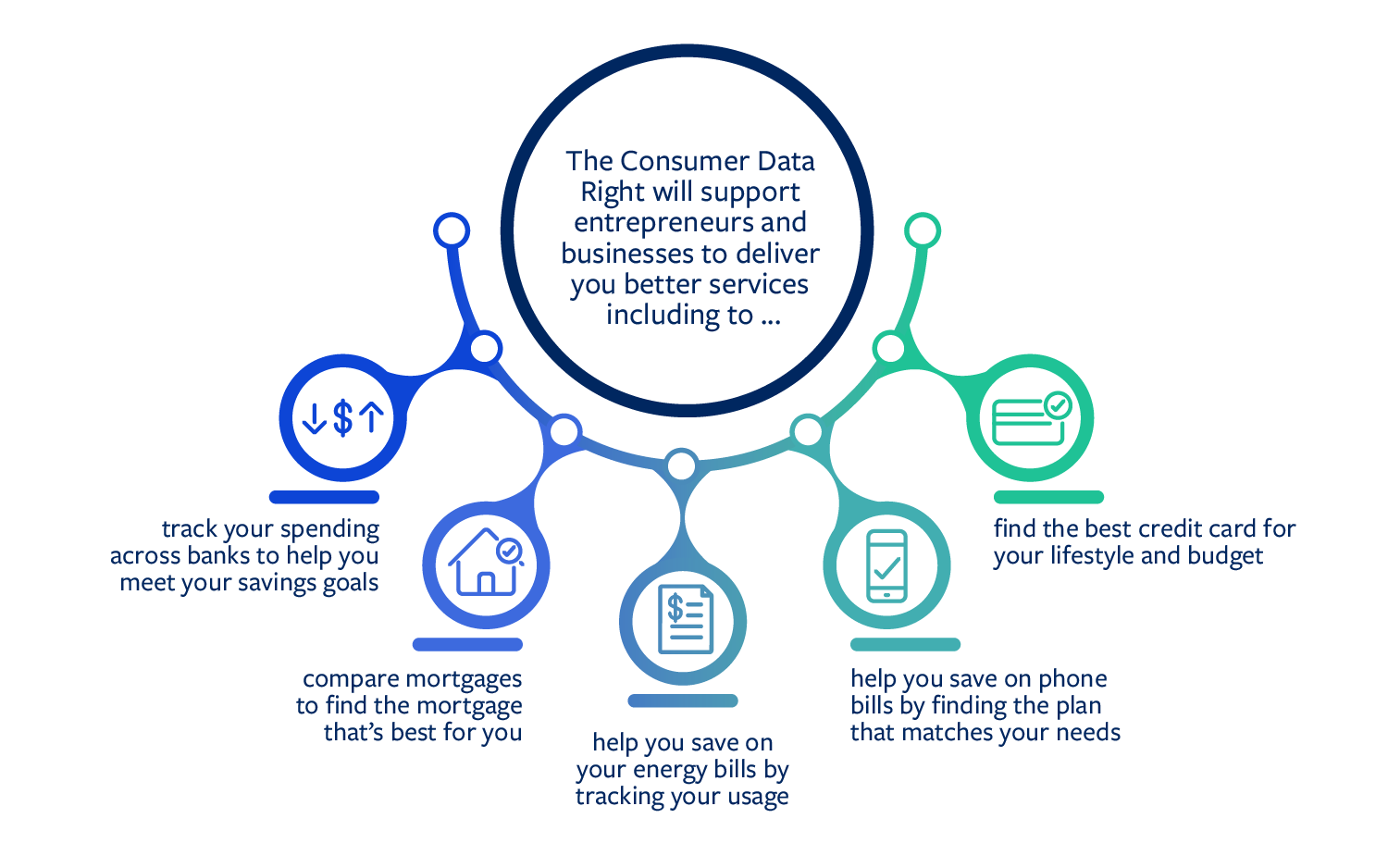

The ability to easily share data paves the way for new products and services. It also makes it easier for individuals and small businesses to compare products, which could give them an incentive to switch providers or talk to their current provider to access a better-value deal. In turn, this encourages more competition in the marketplace and lower prices. Increased competition helps to drive the economy and spurs innovation.

The CDR is also an important foundation for Australia to grow a strong and dynamic digital economy.

Who's involved

The Treasury leads CDR policy, including development of rules and advice to government on which sectors CDR should apply to in the future. The Hon Dr Daniel Mulino MP, Assistant Treasurer and Minister for Financial Services, is the responsible Minister.

Within Treasury, the Data Standards Body develops the standards that prescribe how data is shared under CDR.

Treasury works closely with the two regulators, the Australian Competition and Consumer Commission (ACCC) and the Office of the Australian Information Commission (OAIC) to implement and regulate the CDR.

The ACCC is responsible for the accreditation process, including managing the Consumer Data Right Register. The ACCC ensures providers are complying with the Rules and takes enforcement action where necessary.

The OAIC is responsible for regulating privacy and confidentiality under the CDR. The OAIC also handles complaints and notifications of eligible data breaches relating to CDR data.

Background

Consumer Data Right was introduced in response to several government reviews. The Murray, Harper, Coleman and Finkel inquiries all recommended that Australia develop a right and standards for consumers to access and transfer their information in a usable format.

In December 2020, Minister Hume released the report of the Inquiry into Future Directions for the Consumer Data Right. The report made 100 recommendations to expand and enhance the CDR. The Government is engaging with stakeholders as it develops a response to the report.

On 20 July 2017, the then Treasurer, the Hon. Scott Morrison MP, commissioned the Review into Open Banking in Australia to identify the most appropriate model for open banking. Following the review, the government legislated a Consumer Data Right.

In May 2017, the Australian Government received the Productivity Commission’s report on its Inquiry into Data Availability and Use. The report made 41 recommendations, including the creation of a new economy-wide ‘comprehensive data right’.